For example, fixed costs are things such as rent, lease payments and insurance expense, while labor, raw materials and sales commissions are variable costs. Everything else is a fixed cost, including labour (unless there is a regular and significant chance that workers will not work a full-time week when they report on their first day). A non-operating expense is a cost that is unrelated to the business’s core operations. The IRS treats capital expenses differently than it treats operating expenses.

It is therefore important for both internal and external analysts to identify a company’s opex, to understand its primary cost drivers, and assess management efficiency. A variable cost can change, depending on the production and sales levels of products or services. This can include anything from sales, advertising and marketing to distribution costs to research and development. Senko Cullum suggests retail businesses carefully evaluate the goals and purpose of any capital expenditure, before spending, to understand the expected value or growth potential. “While these are unavoidable costs to keep your business running it is important to be diligent about the level of expenditures and ensure they are workable within your cash flow,” she said.

Operating Expense Definition and How It Compares to Capital Expenses

https://kelleysbookkeeping.com/what-is-the-purpose-of-contra/ are the expenses that arise from daily, core operational activities conducted by a company. Typically, they’re tax deductible as long as a company operates to earn a profit, expenses are commonly known, and necessary. An operating expense is an expense that a business incurs through its normal business operations.

What are four examples of operating expenses?

Insurance, license fees, rent, property taxes, and travel expenses are common examples of operating expenses. An increase in operating expenses means less profit for a business.

The IRS has guidelines related to how businesses must capitalize assets, and there are different classes for different types of assets. Note that not all OpEx are fixed costs, as an item like office supplies can be viewed as more of a variable cost since more purchases would be made if production levels were higher. Unique to operating expenses, the majority of costs classified as OpEx are fixed costs, which means they are NOT directly linked to revenue. It is noteworthy that the same category of an operating expense can be either a fixed cost or a variable cost, depending on the situation. For example, the wage for a full-time office employee is a fixed cost to the company, while the wage for an assembly line factory worker can be identified as a variable cost. Understanding the distinction can help managers to better control the operating expenses while considering the timeframe.

Payment terminal

Occasionally, OpEx can be consolidated into a single line item, but the standard layout is for the expenses to be broken out into multiple line items. Information rights management (IRM) is a discipline that involves managing, controlling and securing content from unwanted access. Cloud computing services are usually bought through Opex, which provides flexibility. A company only pays for what its users consume rather than a specified amount of resources.

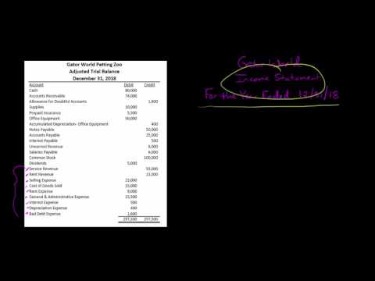

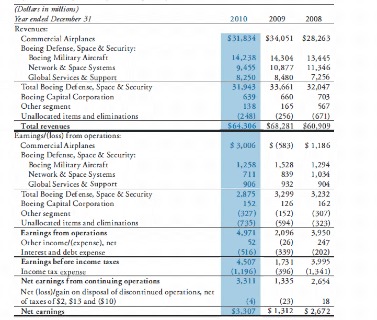

However, the IRS and most accounting principles distinguish between operating expenses and capital expenditures. It typically relates to recurring expenses such as rent, interest payments, insurance payments, and bank fees. Since operating income takes into account operating costs (i.e. COGS and OpEx), it represents the cash flow from core operations before accounting for other non-core sources of income/expenses. Operational expenditures are listed on income statements and can be deducted for the year in which the expenses occurred. Capital expenditures are spent on the improvement or purchase of fixed assets. Capital expenditures are listed on a company’s balance sheet — or in a cash flow statement when they are considered as investments.

What are operating expenses?

However, fixed assets can be depreciated over time to spread out the expense over the useful life of the assets. In accounting, a company’s gross profit is shown as the first line item on the profit and loss statement. Deducting the operating expenses from the gross income gives the operating income. A non-operating expense is an expense incurred by a business that is unrelated to the business’s core operations. The most common types of non-operating expenses are interest charges or other costs of borrowing and losses on the disposal of assets.

Renaissance Theatre receives $219K state grant for operating … – Richland Source

Renaissance Theatre receives $219K state grant for operating ….

Posted: Sat, 20 May 2023 14:00:00 GMT [source]

Opex (operational expenditure) is the money a company or organization spends on an ongoing, day-to-day basis to run its business. Depending on the industry, these expenses can range from the ink used to print documents to the wages employees are paid. Businesses might also pay for cloud computing services and car leasing out of Opex. They include expenditures such as rent, inventory costs, marketing, and payroll, said Hillary Senko Cullum, a wholesale and retail consultant operating at HSC Advisors. Capital expenditures are assets that are purchased and have a multiyear life, and are used in the operations of the business. Purchasing machinery, for example, is considered a capital expenditure, whereas, repair and maintenance of the machinery is considered an operating expense.

The significance of operating expenses

Operational expenditures are usually smaller, regularly occurring expenses that a lower-level manager can approve. Capital expenditures are usually for major purchases designed to be used long term and generally require approval higher up in the organization. For example, businesses are increasingly using technology to reduce their payroll costs without compromising performance. Amid such rising costs, retail stores may be forced to increase the pricing of their merchandise or recognize a reduced profit margin, said Distel. Operating expenses are the essential costs you pay to run and operate your business.

The operating activities primarily cover the commercial activities of the company. The $30 million in SG&A and R&D are the total Operating Expenses of our company. Businesses that compete purely on price may benefit from paring back costs to an absolute minimum. This means they need to keep their costs as low as they reasonably can without compromising on quality. And Distel echoes this advice, adding that tracking and reporting historical costs are integral components of budgeting for (and forecasting) upcoming costs and projected profits. “Performing a routine overhead cost analysis may help a business owner determine ways to reduce costs or make the business run more efficiently,” she said.

Examples of operating expenses

The amount left over after operating expenses have been deducted from gross revenue is known as operating income. For businesses, operating expenses may typically include supplies, advertising expenses, administration fees, wages, rent, and utility costs. When it comes to analyzing operating expenses, managers classify the expenses as either fixed or variable. A fixed cost remains the same no matter what the production level is, while variable cost does vary with the number of products or services that a company produces.

For example, the rent expense for an office is stated on the contract with the building landlord and does not fluctuate based on revenue performance. Square Terminal is the card machine for everything from managing items and taking payments to printing receipts and getting paid. Luke O’Neill writes for growing businesses in fintech, legal SaaS, and education. He owns Genuine Communications, which helps CMOs, founders, and marketing teams to build brands and attract customers.